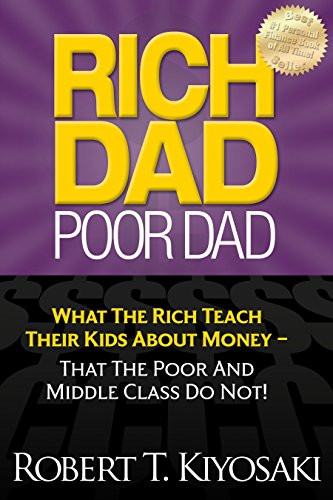

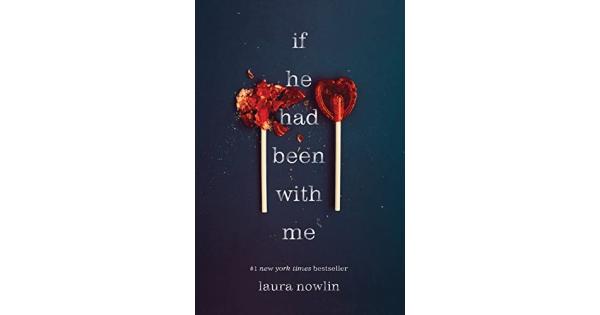

When school seems hard with projects, homework, studying, and sports the time used for personal enjoyment shrinks. Though school has not been in session for too long, I found myself unable to do the things I enjoy such as reading. Hoping to rekindle my old habits, I picked up the book “Rich Dad Poor Dad”. This book brought me out of a slump, providing a brand-new perspective on money and finance I would have otherwise never thought of. With my desire for a good read and curiosity for money, I dove into the world of finances with Robert T. Kiyosaki.

Source: goodreads.com

“Rich Dad Poor Dad” is a 1997 book written by Robert T. Kiyosaki, a man that came from a poor background who flipped his world into that of riches. The book follows young Robert as he lived in Hilo, Hawaii. At the age of 9, Robert and his friend Mike set out to make money and prove their school bullies wrong. With the help of his “rich dad”, Richard Kimi, and his “poor dad”, Ralph H. Kiyosaki, the two boys learned plenty about money and life.

Growing up, Robert and Mike were seen as the poor kids within their school. Their home in Hilo, Hawaii had two schools that were parted into two sections; poor and rich. By chance Robert and Mike ended up going to the school people saw as rich, where all the wealthier kids would go to do their learning. Robert’s journey started when their rich friends refused to invite him and Mike to their beach house for a birthday party, stating they were too poor to come. This both saddened and angered Robert, and from that day forward he wanted to prove them wrong.

Seeing as Mike’s father, Richard Kimi, was a well-off business owner, Robert figured he would just ask him. Yet to his surprise Richard has no intentions of lecturing him or giving him homework like in school, he planed on giving Robert and Mike real experiences by having them work for him. To this a conflict arises, Ralph H. Kiyosaki, Robert’s father, is a teacher, and does all his teaching by lectures. He tells his son to get a good education and nothing else to make money. Richard’s perspective is much different, which caused slight confusion with Robert. Would he go by his “rich dad” or “poor dad’s” words?

Richard tells the boys to get creative, use their brains and think of creative ways to make money, or as he calls, make money work for them. The two boys come up with a comical idea. In the 1950s

Source: thewefire.com

toothpaste tubes were made of lead. Robert and Mike went door-to-door in their neighborhood, collecting empty tubes. When they collected enough, they melted the tubes down and used a mold to create quarters out of the lead. The boys quite literally made money by using their mind to think. They were of course met with a rude awakening when Richard told them about how illegal what they were doing was. This entire section of the book was very funny to me; however, Robert and Mike were very clever.

The lessons Richard taught the boys were very valuable and for the time period they were in, held plenty of truth. One lesson that stood out to me was him telling them to not work for money, but

to let money work for them. Meaning instead of getting a job and living paycheck to paycheck, one should build assets that will continue to generate money long term. When collecting assets, these assets continuously give money even when your not working. Not focusing on how much money your making from a job, saving up money for months and instead building assets that give you money no matter what.

The lesson which I believe is most important is overcoming obstacles. Things like fear, bad habits, and arrogance can absolutely destroy one’s financial wellbeing. Fear ties into what Richard taught the boys plenty, it’s power can overtake your emotions and drive you into being a zombie.

Source :ancientfaces.com

Out of fear many work paycheck to paycheck hoping they will save up enough for a nicer home, maybe a dream car. Richard explains how out of fear one could stick to a low paying job, not taking chances or risks to begin a business to build assets for long term wealth. Bad habits like overspending or making bad financial decisions can destroy one’s wealth and make them build liabilities, not assets. Lastly, arrogance can damage financial well-being by causing overconfidence, poor decision-making, and an unwillingness to seek help. This can lead to greater risks and more severe financial consequences, as arrogance often masks a lack of self-awareness and can be rooted in deep-seated insecurities.

Robert Kiyosaki’s main lesson in Rich Dad Poor Dad is the importance of financial literacy and acquiring income-generating assets to achieve financial independence, it contrasts with the traditional “school system” mindset of working for money.

This book allowed me a peek into Robert’s mind and gave me an entirely new perspective one money. Some concepts were difficult to grasp, but the summarization the book provides me with helped me understand everything fully. I would recommend this book to others who are interested in seeing how business owners may think, and how to begin fully understanding finances as a high school student.